Food inflation eases at a faster pace

Food and non-alcoholic drink annual inflation eased for the third consecutive month in June, reaching 17.4%, down from 18.4% in May. Prices rose on the month too, by 0.4%, although this is the lowest month-on-month rise since March 2022.

View our statement

Topics

The largest downward contribution to the annual rate came from the milk, cheese and eggs category. Two small, partially offsetting upward effects came from sugar, jam, syrups, chocolate and confectionery (particularly chocolate), and mineral waters, soft drinks and juices.

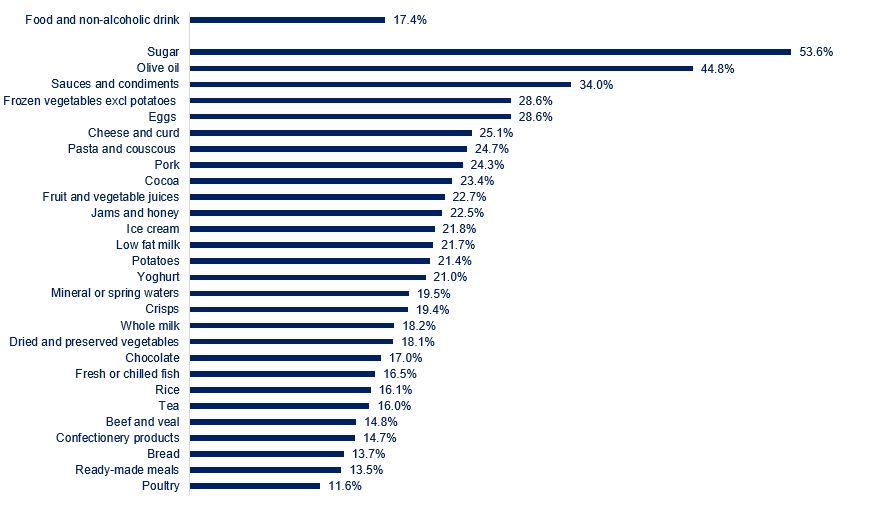

Of the 49 main food categories reported in the official statistics, 45 recorded double-digit inflation, with sugar seeing the highest rise in prices on the year, at 53.6% (see chart), and ‘other tubers’ the lowest, at 4.7%.

Food and non-alcoholic drink inflation by category

Source: ONS

Alongside this slowing food inflation, there was another positive development as overall costs facing food and drink manufacturers fell in June by 1.9% compared to May, the fastest monthly decline since June 2021. Year on year, costs were still 4.8% higher.

By category of costs, annual inflation of UK-sourced ingredients slowed to 1.6% (down from 5.6% in May, and 1.8% lower on the month) and of imported ingredients to 17.4% (down from 23.6% in May and 4.0% lower on the month). While annual inflation of goods leaving manufacturers’ facilities – output gate prices, fell to 8.7% (down from 11.4% in May and 0.1% lower on the month).

This shows yet again that the transmission process of cost changes to retail prices is not a straightforward one. It’s a process that takes anywhere between seven and twelve months as manufacturers use long-term fixed term contracts when purchasing ingredients and raw materials, and fixed-term contracts of various lengths when supplying their customers. This means that changes in global agricultural commodity prices, for example, will not be reflected in retail prices instantaneously. This is similar to a homeowner with a fixed-term mortgage paying a set amount for the duration of the agreed period, even if interest rates vary. It’s also important to note that this lag exists regardless of whether costs increase or decrease. For instance, manufacturers saw their costs rising in October 2020, but retail prices began to increase only in August 2021.

Global food commodity prices have been falling since their March 2022 peak, although they’re still 23% above levels seen in February 2020, with sugar prices 66% higher. The fall in producer costs in June reflects price changes in agricultural commodities that have started to filter through.

Several risks to inflation persist for the near to medium term. The collapse of the Black Sea Grain Initiative earlier this week threatens to push up prices of vegetables oils, wheat and maize. The current heat wave in Southern Europe and El Niño could have damaging impacts for key crops around the world.

Energy markets remain highly volatile, with gas prices varying between £99 and £59/thm over this past month, and futures markets pricing it over £130 for January and February, more than double the pre-pandemic levels. As many food and drink manufacturing processes are energy intensive, this remains a source of concern for the industry.

Labour cost pressures are substantial, with wages being pushed up by severe labour shortages – our industry’s staff vacancy rate was 5.9% in Q1 compared to 3.5% in the whole economy, while workers seek pay rises that reflect the scale of rising costs.

Besides dealing with intense cost pressures for almost three years, from ingredients and packaging to labour, transportation and logistics, and significant margin erosion, manufacturers are also facing a decline in demand. The cost of living crisis has led to a fall in demand in real terms. For instance, in-store food sales have fallen 4% in volume terms over the year to May (see chart).

Food stores sales

Index, 2019 = 100

Source: ONS

At the same time, the rapid increase in interest rates over the last 18 months has made borrowing more expensive, threatening investment in the industry, and, therefore, longer-term growth.

Insolvency figures lay bare the dire circumstances facing many manufacturers, especially smaller businesses that have less market power to negotiate cost price increases with customers. Over the first five months of 2023, insolvencies in our sector have already surpassed the total seen in 2019 by 10%, in stark contrast with the situation in Great Britain as a whole and also within the wider manufacturing sector (see table).

Number of insolvencies

Source: The Insolvency Service

In the wider economy, CPI annual inflation eased to 7.9%, down from 8.7% in May, while core inflation (which excludes more volatile items, such as food and energy) decelerated to 6.9%, down from 7.1% in May, which was the highest since March 1992, and significantly above the Bank of England’s 2.0% target. However, pay growth accelerated in May, with regular wages in the private sector rising by 7.7%, up from 7.6% in April, and regular wages in the public sector climbing 5.8%, up from 5.7% in April.

This means that monetary policy decisionmakers continue to face difficult choices. The Bank of England had increased rates by 50 basis points to 5.0% at their last meeting and a further rise is expected at the next meeting on 3 August. Higher interest rates are meant to slow demand in order to bring inflation down quickly and to signal the Bank’s commitment to its 2.0% target. However, the process through which monetary policy decisions affect the economy, or the transmission mechanism of monetary policy in economics speak, is characterised by long and uncertain time lags. With producers’ costs now on a likely downward trajectory and the harmful impacts to homeowners and renters alike from mortgage rates hikes, the Bank will need to calibrate its response carefully.

We need the government to continue to work with us quickly and decisively to mitigate these issues – for example with a firm focus on better regulation that is co-designed with industry to deliver desired policy outcomes while also reducing cost burdens placed on industry to create the best conditions to deliver required investment and economic growth.