Sharpest inflation drop yet

Food and non-alcoholic drink annual inflation slowed for the fourth consecutive month in July, reaching 14.9%, down from 17.4% in June, the slowest rise since September 2022. This is the sharpest drop in annual inflation yet. On the month, prices rose by 0.1%, a slower pace than June’s 0.4% increase.

Topics

The largest downward contribution to the annual rate came from ‘milk, cheese and eggs’ and ‘bread and cereals’ categories. The only category that did not provide a negative contribution to the monthly change in the annual rate was ‘fish’.

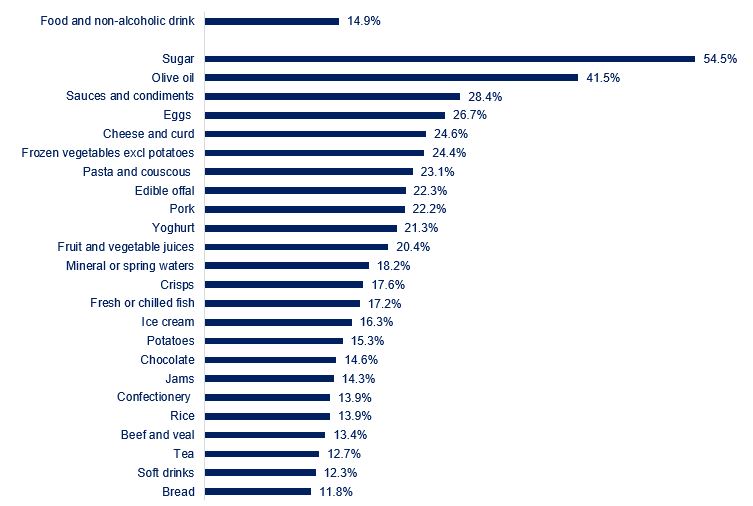

The easing of inflation is widespread, with 40 out of 49 main food categories reported in the official statistics recording annual inflation in double-digits (down from 45 in June) and 13 for which inflation exceeded 20% (down from 19 in June). Inflation was the highest for sugar, at 54.5% (see chart), and the lowest for butter, at 2.2%.

Food and drink inflation by category

Source: ONS

Food inflation will continue to slow, with costs taking anywhere between seven and twelve months to filter into retail prices, although we expect it will reach single-digit levels early next year.

Data from the Office for National Statistics (ONS) show that overall costs facing food and drink manufacturers continued to rise on an annual basis in July, albeit more slowly. Compared to the same period last year, July costs were 3.0% higher (down from 4.5% in June). On the month, costs fell by 0.5%, the fourth consecutive month of declines.

By category of costs, UK-sourced ingredients entered deflationary territory, with annual inflation at -0.1% (down from 1.1% in June, and monthly inflation at -0.5%). Imported ingredients saw a persistent robust pick up in prices, with year-on-year inflation at 16.1% (down from 17.8% in June and monthly inflation at 0.6%). While annual inflation of goods leaving manufacturers’ facilities – output gate prices, fell to 6.3% (down from 8.7% in June and monthly inflation at -0.3%).

Manufacturers are now seeing cost inflation subsiding after almost three years of increases in all elements of the production process, from ingredients and labour to logistics, transportation, packaging and energy. However, retreating inflation is not a guarantee, as movements in commodity markets might bring fresh inflationary pressures and ongoing labour shortages will push wages up.

The collapse of the Black Sea Grain Initiative is likely to increase prices of some agricultural commodities, with July global vegetable oil prices already higher by 12% from June. While the heat wave in Southern Europe and El Niño could impact global crop production. The UK is likely to see lower availability of fresh produce from Europe, therefore higher prices.

Moreover, the industry struggles with significant labour shortages, with a vacancy rate of 5.9% in Q1 compared to 3.5% in the whole economy. On the demand side, the cost of living crisis led households to cut their spend not just on discretionary items, but also on essentials, such as food. In-store food sales have fallen 2.6% in volume terms over the year to June, and about 50% of the population is buying less food than a year ago.

Coupled with squeezed margins, the industry is in a challenging place. Insolvencies continue to rise at a faster pace than in the wider manufacturing sector or GB. In the first half of the year, the industry recorded 161 insolvencies compared to 122 in the whole of 2019.

In the wider economy, CPI annual inflation eased to 6.8%, down from 7.9% in June, the lowest since February 2022. However, core inflation, a measure for underlying inflation that excludes more volatile items such as food and energy, remained stubbornly high at 6.9% and unchanged from June, while service inflation accelerated on the month. At the same time, pay growth was at its highest since records started in 2001. Regular pay rose by 8.2% in June in the private sector and by 6.2% in the public sector.

With high underlying core inflation and solid pay growth fuelling inflation, yet again, the Bank of England is in a difficult position, after it had raised rates again in August to 5.25%. On the face of it, it would seem like the Bank has more work to do to reach its 2.0% inflation target. However, the process of slowing the economy by increasing borrowing costs is not well understood and it’s characterised by long and uncertain time lags. Pay aside, the labour market has shown some slight signs of easing, with a drop in vacancies, number of employees and inactivity rates. With UK producer prices now in deflationary territory and the harmful impacts to homeowners and renters alike from mortgage rates hikes, the Bank will need to calibrate its response carefully.

Government needs to continue to work with us to revisit forthcoming regulation on borders, to help reduce unnecessary cost burdens for businesses and create the right conditions for growth. The upcoming Autumn Statement will be a timely opportunity for the Chancellor to support growth and attract private sector investment.