UK food & drink exports decline as industry calls for removal of bureaucracy to strengthen EU trade

Our latest trade snapshot report released today, saw exports decline by 6.1% in value compared to H1 last year, read the full press release below.

Topics

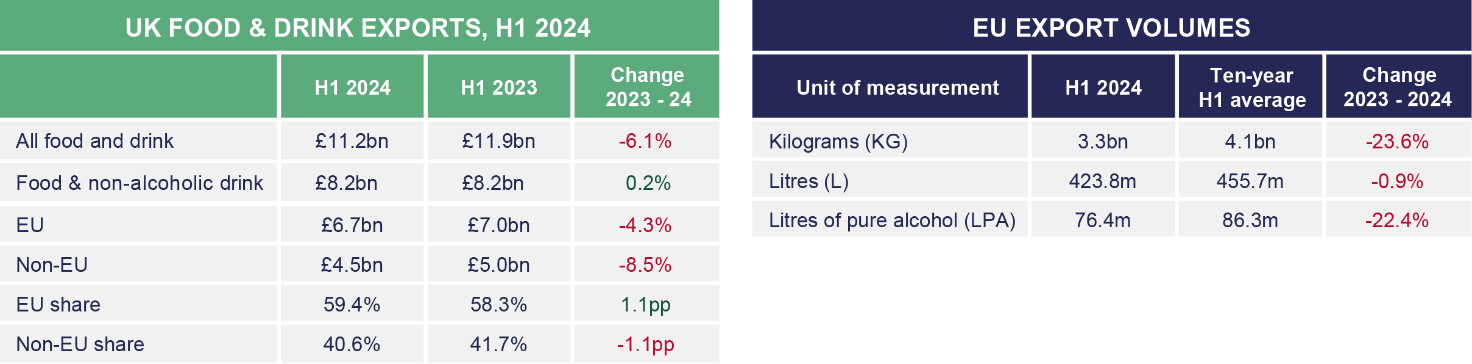

Food and drink export values have fallen 6.1% to £11.2bn in the first six months of 2024, according to the Food and Drink Federation’s (FDF) Trade Snapshot for H1 2024. The decline was driven by a fall in alcohol exports, with food and soft drink exports remaining steady.

Ireland remains the UK’s largest single export market, rising 1.1% to £2.0bn. However, overall exports to the EU, the UK’s biggest trading partner, have fallen by a quarter (23.6%) in volume terms compared to H1 2023, while exports to the rest of the world are up 0.8%. FDF research1 highlights the importance of the EU, which receives 59.4% of all food and drink exports, with more than half (59%) of manufacturers saying that our relationship with the EU should be a top priority for the new government.

Trade with the EU is getting more challenging for British food and drink businesses with growing bureaucracy as additional checks come into force. This includes the second phase of border changes introduced in April raising fees for businesses; an increase in Sanitary and Phytosanitary (SPS) check rates for meat, milk, and fish products from September; and further implementation of border controls applying to fresh produce from 1 July 2025. These new regulations add to the administrative burden for companies, reduce flexibility and increase costs for food and drink – particularly for SMEs.

An SPS agreement would reduce checks, and boosting practical export support would help companies navigate export processes, particularly for SMEs. Reviewing and simplifying the use of Common User Charge would also help businesses.

Balwinder Dhoot, Director of Industrial Growth and Sustainability said:

“The UK’s food and drink businesses make brands and products that consumers love, not just at home but across the world. However, these figures show that manufacturers are facing increasing bureaucratic barriers when exporting, particularly to the EU. There is a lot the Government could do to build exporters’ confidence and support businesses to compete overseas and expand into new markets, including by removing bureaucratic trade barriers.”

Beyond Europe, exports to India have risen by 11.9%, reaching £127.2m in H1 2024 compared to the same period last year. Increased market access through a well-balanced free trade agreement (FTA) has the potential to build on this success and boost trade with India. Another market that could expand for UK exporters is the UAE, with exports rising steadily, by 2.4% in H1, to £202.4m. An ambitious trade agreement with the Gulf Cooperation Council (GCC) could drive significant growth in trade , as we’ve seen under the UK-Australia FTA , where exports have increased by 7.1% to £196.7m.

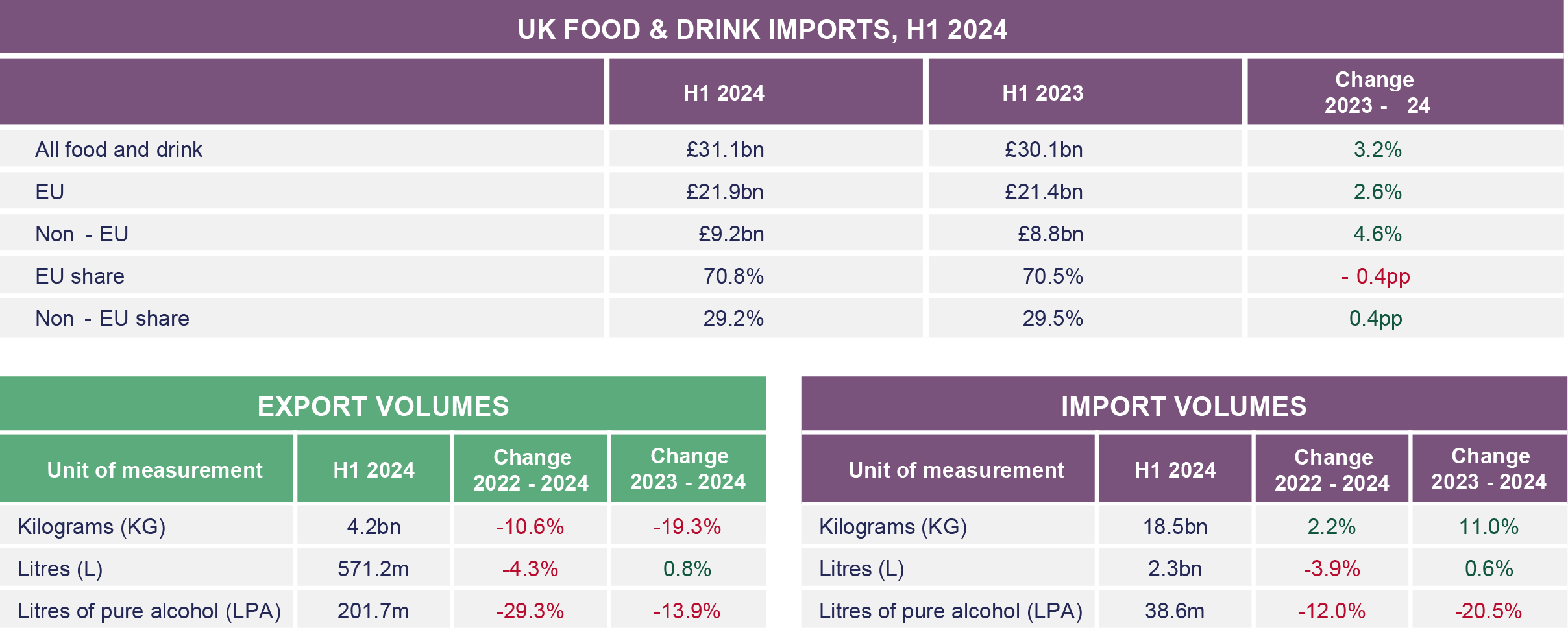

Imports rose again by 3.2% to £31.1bn in H1 2024. Morocco (29.4%), South Africa (24.0%) and New Zealand (22.8%) saw the largest increases. However with 70.8% of our imported food and drink coming from the EU, as with exports , the removal of non-tariff barriers would make a real difference. FDF research1 shows that, for nearly half (47%) of members, administrative costs are a barrier to imports. Removing these obstacles would keep the cost of imports down and help ensure the UK’s continued food security.

-ENDS-

Additional data

Notes:

- FDF has compiled the latest trade figures released by his Majesty’s Customs and Excise. The H1 2024 Trade Snapshot report can be found here.

- An overall volume figure for food and drink can’t be fully obtained as different products are measured in different ways, such as kilograms and litres. Volume figures give a better indicator of the trade picture as they capture both changes in prices – inflation and changes in quantities traded. Products measured in kilograms are mostly food.